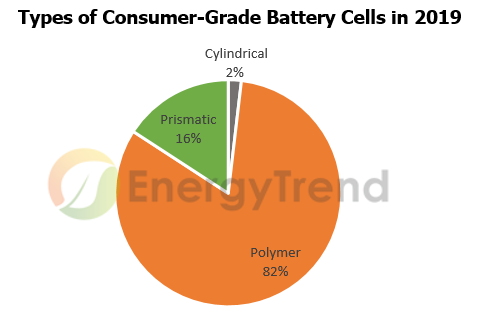

According to EnergyTrend, the Green Energy Research Division from TrendForce, the market share of the polymer battery will increase from 82% in 2019 to 88% in 2020. The following factors have contributed to its rise:

- Major brands of consumer electronics have integrated a large number of polymer (soft pack) batteries into their battery supply.

- Mobile phones, tablets and laptops and other mobile devices continue to get thinner and lighter.

It is expected that the combined proportion of prismatic and cylindrical batteries will be less than 1% in 2024, which will be gradually eliminated by the market. The market share of China's polymer batteries is increasing from 67% in 2018 to 71% in 2020.

Regarding the eco-friendly vehicles, although the overall global automobile market demonstrates slow growth, the trend of vehicle electrification is unstoppable. The car manufacturers, in particular, have proposed timelines for vehicle electrification in recent years. Oil companies are also diversifying their energy business to include renewable energy. The global annual growth rate of all-electric passenger car sales in 2019 is estimated to be still more than 15%. Meanwhile, benefiting from Tesla's price reduction and the release of the affordable Model 3, the global consumption of all-electric passenger car batteries still can grow more than 30% and reach 86 GWh. As Shanghai Tesla starts its mass production in 2020, the global consumption of all-electric passenger car batteries is expected to further increase to 116 GWh (YoY: 34%), of which the share of hybrid (including plug-in hybrid) batteries is estimated to be about 20%.

In addition to the automobile industry, various niche applications of lithium batteries will become more mainstream, benefiting from the decline in their prices. Judging from the changes in the share of each application, the growth of uninterruptible power supplies (UPS) will be particularly obvious in 2020 (YoY 39%), of which the demand for industrial applications is the most sizable. Automotive starting-lighting-ignition batteries (SLI) will also show rapid growth (YoY 57%), as the traditional lead-acid battery manufacturers joined the market. All in all, because the base period of the niche applications in 2019 is still low, it will be the highlight for growth in 2020, whether the application is consumer- or industry-grade.

(Analysis provided by Duff Lu, analyst at EnergyTrend. Translated by Emms Hsu, translator of TrendForce Corp.)