The United States stands as one of the world’s leading markets for large-scale energy storage. While the barriers to entry are currently high, the competitive landscape shows promise. With the anticipated resurgence of photovoltaic (PV) installations in 2023 and the boost provided by increased Investment Tax Credit (ITC) subsidies, the demand for energy storage in the United States is projected to experience accelerated growth.

The United States: the world’s main market for large-scale storage, and is rich in projects

In 2022, the United States witnessed significant advancements in large-scale storage, with a remarkable 4.0 GW of newly installed capacity. Additionally, the installation capacity for large-scale and household energy storage reached 4.80 GW and 12.18 GWh respectively. These figures demonstrate a substantial 80.0% growth in installed capacity from 2017 to 2022. Within this growth, the FTM market accounted for 4.01 GW, indicating a year-on-year increase of 34.6%. Notably, this segment represented 84% of the total installed capacity in 2022 across the United States. However, due to supply chain disruptions and other factors, over 7 GW of energy storage projects slated for 2022 were delayed or canceled, thus limiting overall installation.

Despite a lower-than-anticipated installed capacity of large-scale energy storage in the first quarter of 2023, the United States remains poised for substantial growth, thanks to the sheer magnitude of its ongoing projects. According to data from Wood Mackenzie, the U.S. achieved 2.14 GWh of installed capacity in energy storage during Q1 2023, including 1.55 GWh of large-scale storage, representing a 33% year-on-year decline. The installation capacity has been hampered by supply chain challenges and grid connection delays.

Nevertheless, the U.S. boasts an impressive portfolio of large-scale energy storage projects. As per the Energy Information Administration (EIA) statistics, by the end of 2022, the U.S. had plans to complete 9.4 GW of installed capacity for large-scale storage in 2023. If these projects are successfully executed, the country's large-scale energy storage installations are expected to more than double. It is estimated that the new installed capacity in the U.S. will reach 25.2 GWh in 2023, marking a remarkable 142.1% year-on-year increase.

Graph: U.S.’s New installed energy storage reached 4.80GWand 12.18GWh in 2022

Drivers of U.S. Large-size Storage in 2022: Boost from IRA Subsidies

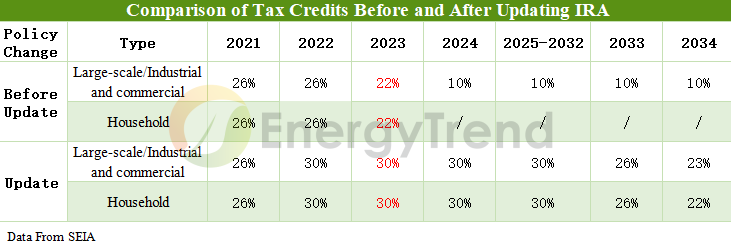

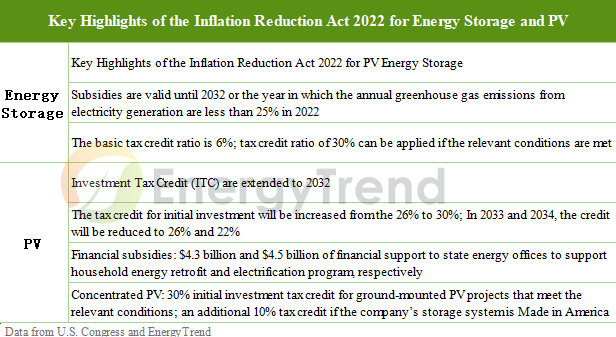

The increase in tax credits and the inclusion of independent energy storage installations in the Investment Tax Credit (ITC) scheme serve as incentives for energy storage deployment. In August 2022, the IRA policy introduced changes to the ITC for PV energy storage systems, raising it from 26% to 30% and extending the eligibility period to 10 years. Furthermore, independent energy storage installations are now eligible for tax credits, which is expected to drive significant growth in installed energy storage capacity.

The U.S. power market is well-established, and the return mechanisms for large-scale storage projects are improving, fostering greater enthusiasm for installations. Large-scale storage projects in the U.S. come in two forms: new energy power plants with storage and independent energy storage facilities. Market demand primarily drives the installed capacity. As for revenue generation, large-scale storage projects can benefit from peak time rebate programs, capacity markets, and auxiliary services markets.

Energy and electricity prices, as well as trading methods for auxiliary services, vary by state in the U.S. In electricity markets such as California (CAISO) and Texas (ERCOT), which lead in large-scale storage installations, these projects already demonstrate favorable commercial returns. According to estimates by Lazard, based on 2022 returns and policy subsidies, the annual revenue for a 100 MW/400 MWh independent energy storage project in California could reach approximately $38.56 million. With the 30% ITC tax credit, the project's internal rate of return (IRR) could reach 34%.

Reportedly, many energy storage companies have accelerated their development in overseas markets, considering them as their primary objectives. In terms of market segmentation, suppliers in the large-scale storage, commercial, and industrial energy storage markets face stringent requirements regarding financing capabilities and project experience. Consequently, companies that have already achieved success in some projects will have a competitive edge in leading the energy storage market.