The board of directors of wafer supplier Sino-American Silicon Products (SAS) approved the financial report for the first quarter of 2022 on the 5th. The company attained a consolidated revenue of NT$18.769 billion, with a gross revenue of NT$7.462 billion, as well as a net operating profit of NT$6.205 billion, and a profit before tax of NT$703 million. A profit after tax of NT$1.265 billion was attributable to the parent company at an EPS of NT$2.16.

Compared to the operating performance of the same period in 2021, SAS saw an increase of 16.9% in consolidated revenue, an increase of 6.1% in gross revenue, an increase of 8.4% in operating profit, a reduction of 2.4% in profit after tax attributable to the parent company, and a reduction of NT$0.33 in EPS. Among which, the continuous growth of semiconductor supplier Globalwafers since the first quarter of 2020 had contributed nearly 90% of revenue for parent company SAS.

The board of directors of SAS also approved the cash dividend issuance for the second half of 2021. SAS plans to issue a cash dividend of NT$4.5 per share in the second half of 2021 at a total sum of NT$2.638 billion, which would equal a cash dividend of NT$8 per share under a total sum of NT$4.690 billion (69% of dividend payout ratio) for the entire year if the cash dividend for the first half of the year at NT$3.5 per share under a total of NT$2.052 billion is incorporated. In addition, SAS also plans to convene its regular shareholders meeting at HSP Link at 9 a.m. on June 23rd.

SAS commented that the surging frequency of climate abnormalities around the world has not only aggravated survival conditions, but also exposed most of the population to direct climate risks. The rising oil prices under the Russia-Ukraine war, as well as the repeated power outages in earlier period, indicate that establishment of tenacious energy systems that are able to respond to extreme weather as well as political and economic unrest is extremely important. Simultaneously, businesses’ pursuit of ESG sustainability and various sectors’ demand in clean energy have provided a support for clean energy in continuous growth. The domestic demand is benefitted by Taiwan’s energy transformation policy, where the government has announced the 2050 net zero emission roadmap that would expand the ratio of clean power to 60-70% by 2050, which significantly encourages replacement with solar and wind power that would satisfy economic growth whilst establishing a non-nuclear home. The energy blueprint planned by the government aims to accumulate 20GW of PV installations by 2025, before climbing to 40-80GW by 2050, which is expected to trigger a robust demand for renewable energy.

As a comprehensive renewable energy supplier, SAS not only coordinates with global energy policies by promising 100% utilization of renewable energy for all of its subsidiaries prior to 2050, but is also dedicated to elevating the conversion efficiency of mono-Si cells in order to maintain market competitiveness, and is expected to complete capacity and process upgrades within 2022 that would help the company in grasping on popular market orders. While focusing on the operation of downstream power plants, SAS is also aggressively engaged in energy storage and renewable energy by fully assisting Globalwafers as well as its upstream and downstream strategic partners in increasing the ratio of green power, in the hope of creating dynamics for its solar business and expanding paths of growth.

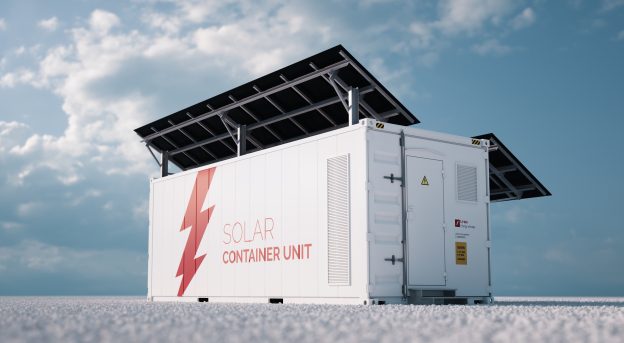

(Cover photo source: official site)